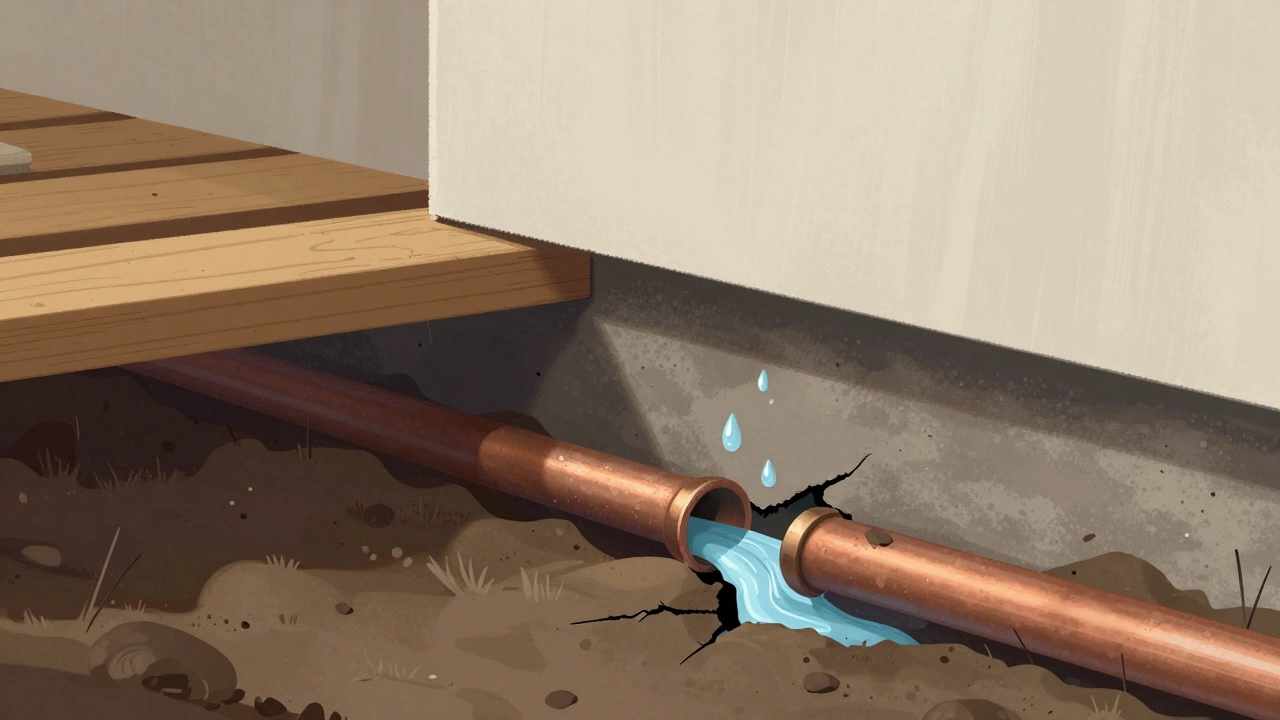

If you’ve noticed a sudden drop in water pressure, damp spots on your floor, or the sound of running water when nothing’s turned on, you might be dealing with a broken pipe under your home’s foundation. And if you’re asking whether your homeowners insurance will cover it, you’re not alone. This is one of the most common - and confusing - claims homeowners make every year.

Most Homeowners Insurance Policies Don’t Cover the Pipe Itself

Homeowners insurance typically covers damage caused by sudden and accidental events. That means if a pipe bursts because of freezing temperatures or corrosion, the water damage to your walls, floors, and ceilings is usually covered. But the pipe itself? That’s a different story.Insurance companies see plumbing pipes as part of your home’s maintenance system. They’re expected to last for decades with proper care. If a pipe breaks because it’s old, corroded, or poorly installed, that’s considered wear and tear. And wear and tear isn’t covered. This applies whether the pipe is under your slab foundation, in your crawl space, or running through your basement.

Think of it this way: your insurance won’t replace your old, leaking water heater. It won’t replace your cracked roof shingles from years of sun exposure. Same logic applies to pipes under your foundation. The damage they cause? Covered. The pipe that broke? Not so much.

What You Are Covered For

Even if the pipe itself isn’t covered, the water damage it causes often is. If a hidden pipe bursts under your slab and floods your living room, your policy will likely pay for:- Water extraction and drying out your home

- Repairing damaged drywall, flooring, and insulation

- Replacing ruined furniture or carpets

- Temporary housing if your home becomes uninhabitable

These are the real costs that matter. A broken pipe under your foundation can lead to mold, structural rot, and electrical hazards - all of which are serious risks. Your insurance is designed to protect you from those consequences, not to maintain your plumbing.

For example, in Melbourne, where older homes with concrete slab foundations are common, water damage from slab leaks is one of the top 10 insurance claims each year. In 2024, the average payout for water damage from hidden plumbing leaks was around $18,500 - but the cost to replace the actual pipe was never included in that figure.

When You Might Get Coverage for the Pipe

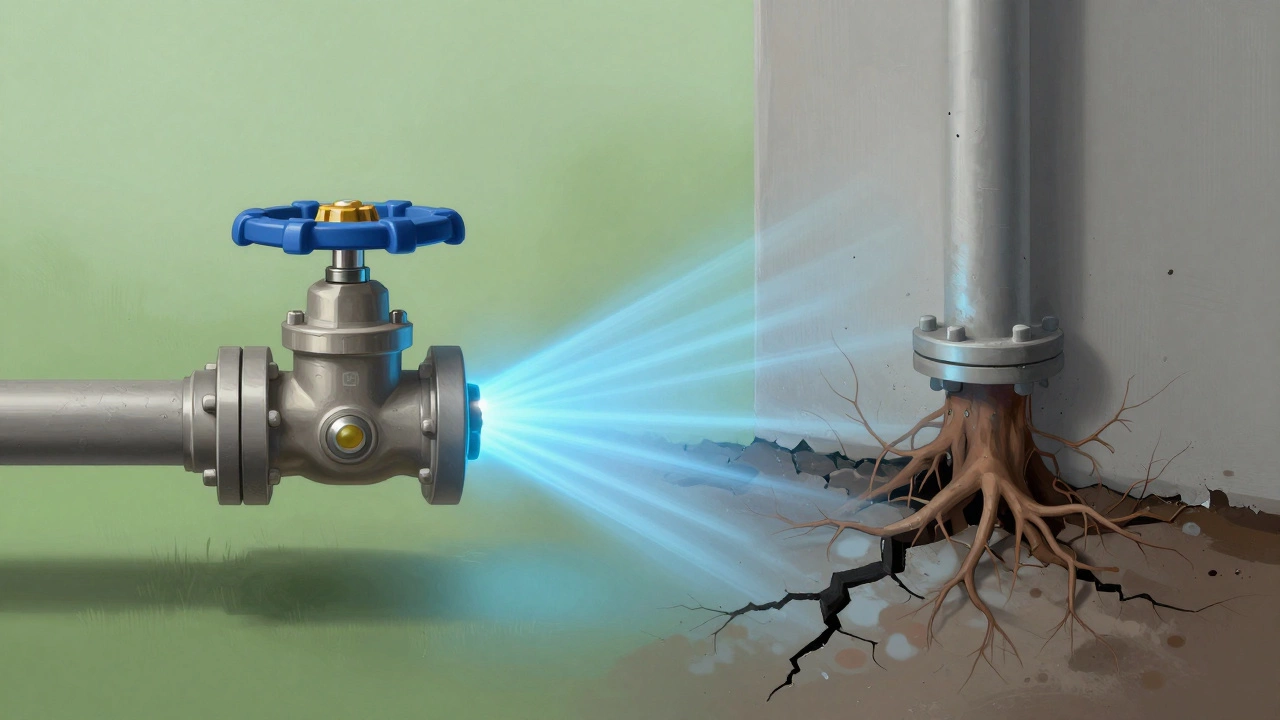

There are rare exceptions. If the pipe broke because of something sudden and outside your control, your insurer might cover the repair. Here are the two main scenarios:- Sudden and accidental damage - Like if a tree root suddenly ruptured the pipe during a storm, or a construction crew digging nearby accidentally hit it with a backhoe.

- Damage from a covered peril - For instance, if a fire caused your pipe to melt, or if a landslide shifted your foundation and snapped the pipe.

These are uncommon. Most slab leaks happen slowly over time. Corrosion from acidic soil, mineral buildup, or poor installation isn’t sudden. It’s gradual. And that’s the key word: sudden. Insurance only kicks in for what happens fast, not what’s been failing for years.

What’s Not Covered - And Why

Here’s what most policies explicitly exclude when it comes to plumbing under the foundation:- Leaks from aging pipes (over 15-20 years old)

- Corrosion due to water quality or soil chemistry

- Improper installation or poor workmanship

- Damage from tree roots growing into pipes over time

- Gradual seepage or slow drips that go unnoticed

These are all considered preventable with regular maintenance. If you’ve never had your plumbing inspected since you bought the house 20 years ago, your insurer won’t treat a burst pipe as an accident. They’ll treat it as neglect.

Some policies even have clauses that void coverage if you don’t shut off your water when you’re away for more than 72 hours. In Melbourne’s dry climate, homeowners often leave their homes unattended for weeks during summer. A slow leak left unchecked for a month? That’s not covered.

How to Prove It Was Sudden (If You Want to Claim)

If you believe your pipe broke suddenly - say, after a major ground shift or an underground utility work nearby - you’ll need proof. Insurance adjusters don’t take your word for it.Here’s what they’ll want:

- A report from a licensed plumber showing the cause of the break

- Photos or video of the damage at the time of discovery

- Weather or construction records (e.g., a recent earth tremor or roadwork near your property)

- Proof that the pipe was recently inspected and in good condition

If you’ve had a plumbing inspection in the last year and it came back clean, that’s your best shot. If you haven’t, your claim will likely be denied.

What You Should Do Instead

Don’t rely on insurance to fix your pipes. Instead, take control:- Get a sewer scope - For under $300, a plumber can run a camera down your main line and show you the condition of pipes under your foundation. Do this every 5 years, especially in homes over 20 years old.

- Install a water shutoff system - Smart valves like the Flo by Moen or Phyn can detect leaks and shut off your water automatically. Many insurers give discounts for these.

- Check your water bill monthly - A sudden spike in usage is often the first sign of a hidden leak. If your bill jumps 20% without reason, call a plumber.

- Consider a home warranty - Unlike insurance, home warranties cover aging systems. Most cover plumbing under slabs for $400-$600 a year. They won’t pay for water damage, but they’ll fix the pipe.

One Melbourne homeowner, after a $12,000 repair from a slab leak, spent $500 on a home warranty the next year. When another leak happened 14 months later, the warranty covered the entire pipe replacement. That’s the kind of protection insurance won’t give you.

Bottom Line: Insurance Pays for Damage, Not Maintenance

Your homeowners insurance is there to protect you from disasters - fires, storms, theft. It’s not a maintenance plan. Broken pipes under your foundation are a maintenance issue. The water damage they cause? That’s covered. The pipe itself? You’re on your own.If you’re worried about hidden plumbing problems, don’t wait for a flood. Get a camera inspection. Install a smart shutoff valve. Get a home warranty. These steps cost less than one major leak - and they give you real peace of mind.

Does homeowners insurance cover slab leaks?

Homeowners insurance covers the water damage caused by slab leaks - like ruined flooring, drywall, and mold - but not the broken pipe itself. The pipe is considered a maintenance issue, and insurance doesn’t pay for replacing aging or corroded plumbing.

What if the pipe broke because of a tree root?

If tree roots slowly grew into the pipe over years, it’s not covered. But if a storm uprooted a tree and it suddenly crushed the pipe, you might have a claim. You’ll need evidence - photos, an arborist report, and a plumber’s statement - to prove it was sudden and accidental.

Can I add coverage for broken pipes under my foundation?

Most standard policies won’t let you add this coverage. But you can buy a home warranty that includes plumbing under slabs. Some insurers offer endorsements for water backup or sewer line coverage, but these rarely extend to pipes buried under foundations. A home warranty is your best bet.

How do I know if I have a hidden pipe leak?

Watch for: a sudden spike in your water bill, the sound of running water when no taps are on, damp spots on floors or walls, a drop in water pressure, or warm spots on concrete floors. The easiest way to confirm? Hire a plumber for a sewer camera inspection - it takes less than an hour and costs under $300.

Is foundation repair covered if a pipe leak caused it?

If water from a covered leak caused your foundation to crack or shift, your insurance might cover the foundation repair - but only if the original leak was covered. If the pipe broke from age and caused the foundation damage, neither the pipe nor the foundation will be covered. You need to prove the leak was sudden and accidental.